Sep 24 JDN 2460212

I’ve written before about how free trade has brought great benefits, but also great costs. It occurred to me this week that there is a fairly simple reason why free trade has never been as good for the world as the models would suggest: Some factors of production are harder to move than others.

To some extent this is due to policy, especially immigration policy. But it isn’t just that.There are certain inherent limitations that render some kinds of inputs more mobile than others.

Broadly speaking, there are five kinds of inputs to production: Land, labor, capital, goods, and—oft forgotten—ideas.

You can of course parse them differently: Some would subdivide different types of labor or capital, and some things are hard to categorize this way. The same product, such as an oven or a car, can be a good or capital depending on how it’s used. (Or, consider livestock: is that labor, or capital? Or perhaps it’s a good? Oddly, it’s often discussed as land, which just seems absurd.) Maybe ideas can be considered a form of capital. There is a whole literature on human capital, which I increasingly find distasteful, because it seems to imply that economists couldn’t figure out how to value human beings except by treating them as a machine or a financial asset.

But this four-way categorization is particularly useful for what I want to talk about today. Because the rate at which those things move is very different.

Ideas move instantly. It takes literally milliseconds to transmit an idea anywhere in the world. This wasn’t always true; in ancient times ideas didn’t move much faster than people, and it wasn’t until the invention of the telegraph that their transit really became instantaneous. But it is certainly true now; once this post is published, it can be read in a hundred different countries in seconds.

Goods move in hours. Air shipping can take a product just about anywhere in less than a day. Sea shipping is a bit slower, but not radically so. It’s never been easier to move goods all around the world, and this has been the great success of free trade.

Capital moves in weeks. Here it might be useful to subdivide different types of capital: It’s surely faster to move an oven or even a car (the more good-ish sort of capital) than it is to move an entire factory (capital par excellence). But all in all, we can move stuff pretty fast these days. If you want to move your factory to China or Indonesia, you can probably get it done in a matter of weeks or at most months.

Labor moves in months. This one is a bit ironic, since it is surely easier to carry a single human person—or even a hundred human people—than all the equipment necessary to run an entire factory. But moving labor isn’t just a matter of physically carrying people from one place to another. It’s not like tourism, where you just pack and go. Moving labor requires uprooting people from where they used to live and letting them settle in a new place. It takes a surprisingly long time to establish yourself in a new environment—frankly even after two years in Edinburgh I’m not sure I quite managed it. And all the additional restrictions we’ve added involving border crossings and immigration laws and visas only make it that much slower.

Land moves never. This one seems perfectly obvious, but is also often neglected. You can’t pick up a mountain, a lake, a forest, or even a corn field and carry it across the border. (Yes, eventually plate tectonics will move our land around—but that’ll be millions of years.) Basically, land stays put—and so do all the natural environments and ecosystems on that land. Land isn’t as important for production as it once was; before industrialization, we were dependent on the land for almost everything. But we absolutely still are dependent on the land! If all the topsoil in the world suddenly disappeared, the economy wouldn’t simply collapse: the human race would face extinction. Moreover, a lot of fixed infrastructure, while technically capital, is no more mobile than land. We couldn’t much more easily move the Interstate Highway System to China than we could move Denali.

So far I have said nothing particularly novel. Yeah, clearly it’s much easier to move a mathematical theorem (if such a thing can even be said to “move”) than it is to move a factory, and much easier to move a factory than to move a forest. So what?

But now let’s consider the impact this has on free trade.

Ideas can move instantly, so free trade in ideas would allow all the world to instantaneously share all ideas. This isn’t quite what happens—but in the Internet age, we’re remarkably close to it. If anything, the world’s governments seem to be doing their best to stop this from happening: One of our most strictly-enforced trade agreements, the TRIPS Accord, is about stopping ideas from spreading too easily. And as far as I can tell, region-coding on media goes against everything free trade stands for, yet here we are. (Why, it’s almost as if these policies are more about corporate profits than they ever were about freedom!)

Goods and capital can move quickly. This is where we have really felt the biggest effects of free trade: Everything in the US says “made in China” because the capital is moved to China and then the goods are moved back to the US.

But it would honestly have made more sense to move all those workers instead. For all their obvious flaws, US institutions and US infrastructure are clearly superior to those in China. (Indeed, consider this: We may be so aware of the flaws because the US is especially transparent.) So, the most absolutely efficient way to produce all those goods would be to leave the factories in the US, and move the workers from China instead. If free trade were to achieve its greatest promises, this is the sort of thing we would be doing.

Of course that is not what we did. There are various reasons for this: A lot of the people in China would rather not have to leave. The Chinese government would not want them to leave. A lot of people in the US would not want them to come. The US government might not want them to come.

Most of these reasons are ultimately political: People don’t want to live around people who are from a different nation and culture. They don’t consider those people to be deserving of the same rights and status as those of their own country.

It may sound harsh to say it that way, but it’s clearly the truth. If the average American person valued a random Chinese person exactly the same as they valued a random other American person, our immigration policy would look radically different. US immigration is relatively permissive by world standards, and that is a great part of American success. Yet even here there is a very stark divide between the citizen and the immigrant.

There are morally and economically legitimate reasons to regulate immigration. There may even be morally and economically legitimate reasons to value those in your own nation above those in other nations (though I suspect they would not justify the degree that most people do). But the fact remains that in terms of pure efficiency, the best thing to do would obviously be to move all the people to the place where productivity is highest and do everything there.

But wouldn’t moving people there reduce the productivity? Yes. Somewhat. If you actually tried to concentrate the entire world’s population into the US, productivity in the US would surely go down. So, okay, fine; stop moving people to a more productive place when it has ceased to be more productive. What this should do is average out all the world’s labor productivity to the same level—but a much higher level than the current world average, and frankly probably quite close to its current maximum.

Once you consider that moving people and things does have real costs, maybe fully equaling productivity wouldn’t make sense. But it would be close. The differences in productivity across countries would be small.

They are not small.

Labor productivity worldwide varies tremendously. I don’t count Ireland, because that’s Leprechaun Economics (this is really US GDP with accounting tricks, not Irish GDP). So the prize for highest productivity goes to Norway, at $100 per worker hour (#ScandinaviaIsBetter). The US is doing the best among large countries, at an impressive $73 per hour. And at the very bottom of the list, we have places like Bangladesh at $4.79 per hour and Cambodia at $3.43 per hour. So, roughly speaking, there is about a 20-to-1 ratio between the most productive and least productive countries.

I could believe that it’s not worth it to move US production at $73 per hour to Norway to get it up to $100 per hour. (For one thing, where would we fit it all?) But I find it far more dubious that it wouldn’t make sense to move most of Cambodia’s labor to the US. (Even all 16 million people is less than what the US added between 2010 and 2020.) Even given the fact that these Cambodian workers are less healthy and less educated than American workers, they would almost certainly be more productive on the other side of the Pacific, quite likely ten times as productive as they are now. Yet we haven’t moved them, and have no plans to.

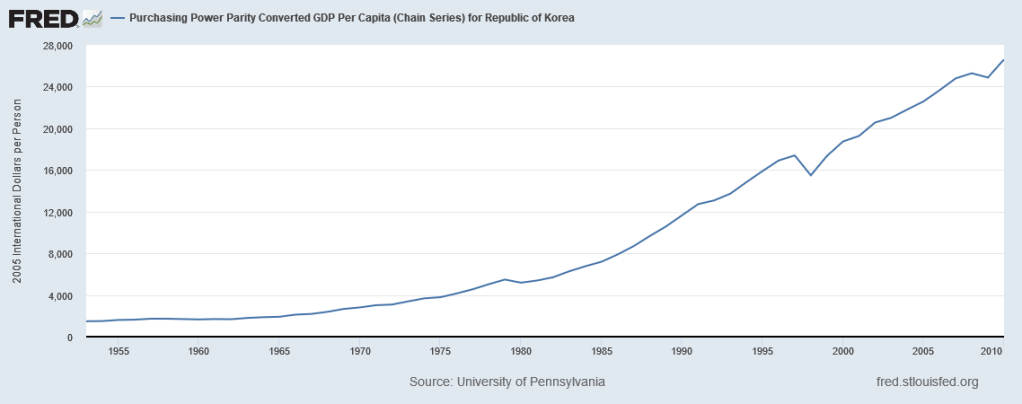

That leaves the question of whether we will move our capital to them. We have been doing so in China, and it worked (to a point). Before that, we did it in Korea and Japan, and it worked. Cambodia will probably come along sooner or later. For now, that seems to be the best we can do.

But I still can’t shake the thought that the world is leaving trillions of dollars on the table by refusing to move people. The inequality of factor mobility seems to be a big part of the world’s inequality, period.