Oct 1 JDN 2460219

The phrase “artificial intelligence” (AI) has now become so diluted by overuse that we needed to invent a new term for its original meaning. That term is now “artificial general intelligence” (AGI). In the 1950s, AI meant the hypothetical possibility of creating artificial minds—machines that could genuinely think and even feel like people. Now it means… pathing algorithms in video games and chatbots? The goalposts seem to have moved a bit.

It seems that AGI has always been 20 years away. It was 20 years away 50 years ago, and it will probably be 20 years away 50 years from now. Someday it will really be 20 years away, and then, 20 years after that, it will actually happen—but I doubt I’ll live to see it. (XKCD also offers some insight here: “It has not been conclusively proven impossible.”)

We make many genuine advances in computer technology and software, which have profound effects—both good and bad—on our lives, but the dream of making a person out of silicon always seems to drift ever further into the distance, like a mirage on the desert sand.

Why is this? Why do so many people—even, perhaps especially,experts in the field—keep thinking that we are on the verge of this seminal, earth-shattering breakthrough, and ending up wrong—over, and over, and over again? How do such obviously smart people keep making the same mistake?

I think it may be because, all along, we have been laboring under the tacit assumption of a generalization faculty.

What do I mean by that? By “generalization faculty”, I mean some hypothetical mental capacity that allows you to generalize your knowledge and skills across different domains, so that once you get good at one thing, it also makes you good at other things.

This certainly seems to be how humans think, at least some of the time: Someone who is very good at chess is likely also pretty good at go, and someone who can drive a motorcycle can probably also drive a car. An artist who is good at portraits is probably not bad at landscapes. Human beings are, in fact, able to generalize, at least sometimes.

But I think the mistake lies in imagining that there is just one thing that makes us good at generalizing: Just one piece of hardware or software that allows you to carry over skills from any domain to any other. This is the “generalization faculty”—the imagined faculty that I think we do not have, indeed I think does not exist.

Computers clearly do not have the capacity to generalize. A program that can beat grandmasters at chess may be useless at go, and self-driving software that works on one type of car may fail on another, let alone a motorcycle. An art program that is good at portraits of women can fail when trying to do portraits of men, and produce horrific Daliesque madness when asked to make a landscape.

But if they did somehow have our generalization capacity, then, once they could compete with us at some things—which they surely can, already—they would be able to compete with us at just about everything. So if it were really just one thing that would let them generalize, let them leap from AI to AGI, then suddenly everything would change, almost overnight.

And so this is how the AI hype cycle goes, time and time again:

- A computer program is made that does something impressive, something that other computer programs could not do, perhaps even something that human beings are not very good at doing.

- If that same prowess could be generalized to other domains, the result would plainly be something on par with human intelligence.

- Therefore, the only thing this computer program needs in order to be sapient is a generalization faculty.

- Therefore, there is just one more step to AGI! We are nearly there! It will happen any day now!

And then, of course, despite heroic efforts, we are unable to generalize that program’s capabilities except in some very narrow way—even decades after having good chess programs, getting programs to be good at go was a major achievement. We are unable to find the generalization faculty yet again. And the software becomes yet another “AI tool” that we will use to search websites or make video games.

For there never was a generalization faculty to be found. It always was a mirage in the desert sand.

Humans are in fact spectacularly good at generalizing, compared to, well, literally everything else in the known universe. Computers are terrible at it. Animals aren’t very good at it. Just about everything else is totally incapable of it. So yes, we are the best at it.

Yet we, in fact, are not particularly good at it in any objective sense.

In experiments, people often fail to generalize their reasoning even in very basic ways. There’s a famous one where we try to get people to make an analogy between a military tactic and a radiation treatment, and while very smart, creative people often get it quickly, most people are completely unable to make the connection unless you give them a lot of specific hints. People often struggle to find creative solutions to problems even when those solutions seem utterly obvious once you know them.

I don’t think this is because people are stupid or irrational. (To paraphrase Sydney Harris: Compared to what?) I think it is because generalization is hard.

People tend to be much better at generalizing within familiar domains where they have a lot of experience or expertise; this shows that there isn’t just one generalization faculty, but many. We may have a plethora of overlapping generalization faculties that apply across different domains, and can learn to improve some over others.

But it isn’t just a matter of gaining more expertise. Highly advanced expertise is in fact usually more specialized—harder to generalize. A good amateur chess player is probably a good amateur go player, but a grandmaster chess player is rarely a grandmaster go player. Someone who does well in high school biology probably also does well in high school physics, but most biologists are not very good physicists. (And lest you say it’s simply because go and physics are harder: The converse is equally true.)

Humans do seem to have a suite of cognitive tools—some innate hardware, some learned software—that allows us to generalize our skills across domains. But even after hundreds of millions of years of evolving that capacity under the highest possible stakes, we still basically suck at it.

To be clear, I do not think it will take hundreds of millions of years to make AGI—or even millions, or even thousands. Technology moves much, much faster than evolution. But I would not be surprised if it took centuries, and I am confident it will at least take decades.

But we don’t need AGI for AI to have powerful effects on our lives. Indeed, even now, AI is already affecting our lives—in mostly bad ways, frankly, as we seem to be hurtling gleefully toward the very same corporatist cyberpunk dystopia we were warned about in the 1980s.

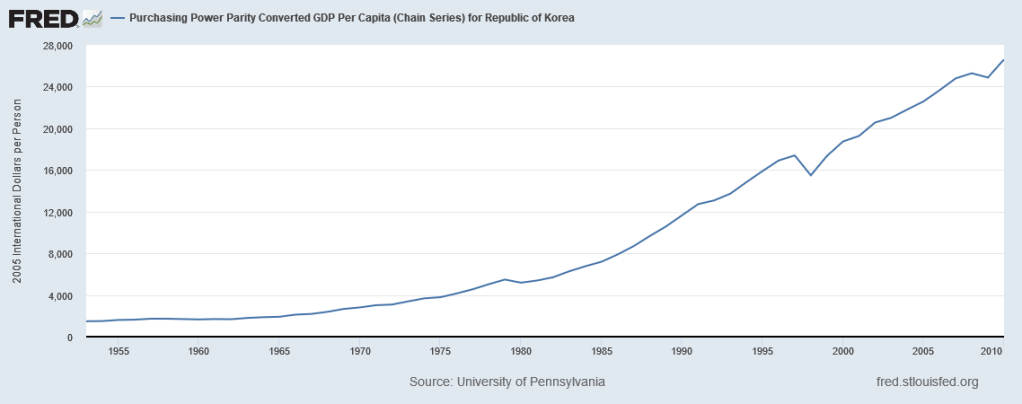

A lot of technologies have done great things for humanity—sanitation and vaccines, for instance—and even automation can be a very good thing, as increased productivity is how we attained our First World standard of living. But AI in particular seems best at automating away the kinds of jobs human beings actually find most fulfilling, and worsening our already staggering inequality. As a civilization, we really need to ask ourselves why we got automated writing and art before we got automated sewage cleaning or corporate management. (We should also ask ourselves why automated stock trading resulted in even more money for stock traders, instead of putting them out of their worthless parasitic jobs.) There are technological reasons for this, yes; but there are also cultural and institutional ones. Automated teaching isn’t far away, and education will be all the worse for it.

To change our lives, AI doesn’t have to be good at everything. It just needs to be good at whatever we were doing to make a living. AGI may be far away, but the impact of AI is already here.

Indeed, I think this quixotic quest for AGI, and all the concern about how to control it and what effects it will have upon our society, may actually be distracting from the real harms that “ordinary” “boring” AI is already having upon our society. I think a Terminator scenario, where the machines rapidly surpass our level of intelligence and rise up to annihilate us, is quite unlikely. But a scenario where AI puts millions of people out of work with insufficient safety net, triggering economic depression and civil unrest? That could be right around the corner.

Frankly, all it may take is getting automated trucks to work, which could be just a few years. There are nearly 4 million truck drivers in the United States—a full percentage point of employment unto itself. And the Governor of California just vetoed a bill that would require all automated trucks to have human drivers. From an economic efficiency standpoint, his veto makes perfect sense: If the trucks don’t need drivers, why require them? But from an ethical and societal standpoint… what do we do with all the truck drivers!?