Jun 8 JDN 2460835

And now back to our regularly scheduled programming. We’re back to talking about economics, which in our current environment pretty much always means bad news. The budget the House passed is pretty much the same terrible one Trump proposed.

The Congressional Budget Office (CBO), one of those bureaucratic agencies that most people barely even realize exists, but is actually extremely useful, spectacularly competent, and indeed one of the most important and efficient agencies in the world, has released its official report on the Trump budget that recently passed the House. (Other such agencies include the Bureau of Labor Statistics and the Bureau of Economic Analysis. US economic statistics are among the best in the world—some refer to them as the “gold standard”, but I refuse to insult them in that way.)

The whole thing is pretty long, but you can get a lot of the highlights from the summary tables.

The tables are broken down by the House committee responsible for choosing them; here are the effects on the federal budget deficit the CBO predicts for the next 5 and 10 years. For these numbers, positive means more deficit (bad), negative means less deficit (good).

| Commitee | 5 years | 10 years |

| Agriculture | -88,304 | -238,238 |

| Armed Services | 124,602 | 143,992 |

| Education and Workforce | -253,295 | -349,142 |

| Energy and Commerce | -247,074 | -995,062 |

| Financial Services | -373 | -5,155 |

| Homeland Security | 27,874 | 67,147 |

| Judiciary | 26,989 | 6,910 |

| Natural Resources | -4,789 | -20,158 |

| Oversight and Government Reform | -17,449 | -50,951 |

| Transportation and Infrastructure | -361 | -36,551 |

| Ways and Means | 2,199,403 | 3,767,402 |

These are in units of millions of dollars.

Almost all the revenue comes from the Ways and Means committee, because that’s the committee that sets tax rates. (If you hate your taxes, don’t hate the IRS; hate the Ways and Means Committee.) So for all the other departments, we can basically take the effect on the deficit as how much spending was changing.

If this budget makes it through the Senate, Trump will almost certainly sign it into law. If that happens:

We’ll be cutting $238 billion from Agriculture Committee programs: And most of where those cuts come from are programs that provide food for poor people.

We’ll be adding $144 billion to the military budget, and a further $67 billion to “homeland security” (which here mostly means CBP and ICE). Honestly, I was expecting more, so I’m vaguely relieved.

We’ll be cutting $349 billion from Education and Workforce programs; this is mostly coming from the student loan system, so we can expect much more brutal repayment requirements for people with student loans.

We’ll be cutting almost $1 trillion from Energy and Commerce programs; this is mainly driven by massive cuts to Medicare and Medicaid (why are they handled by this committee? I don’t know).

The bill itself doesn’t clearly specify, so the CBO issued another report offering some scenarios for how these budget cuts could be achieved. Every single scenario results in millions of people losing coverage, and the one that saves the most money would result in 5.5 million people losing some coverage and 2.4 million becoming completely uninsured.

The $20 billion from Natural Resources mostly involves rolling back environmental regulations, cutting renewable energy subsidies, and making it easier to lease federal lands for oil and gas drilling. All of these are bad, and none of them are surprising; but their effect on the budget is pretty small.

The Oversight and Government Reform portion is reducing the budget deficit by $51 billion mainly by forcing federal employees to contribute a larger share of their pensions—which is to say, basically cutting federal salaries across the board. While this has a small effect on the budget, it will impose substantial harm on the federal workforce (which has already been gutted by DOGE).

The Transportation and Infrastructure changes involve expansions of the Coast Guard (why are they not in Armed Services again?) along with across-the-board cuts of anything resembling support for sustainability or renewable energy; but the main way they actually decrease the deficit is by increasing the cost of registering cars. I think they’re trying to look like they are saving money by cutting “wasteful” (read: left-wing) programs, but in fact they mainly just made it more expensive to own a car—which, quite frankly, is probably a good thing from an environmental perspective.

Then, last but certainly not least, we come to the staggering $3.7 trillion increase in our 10-year deficit from the Ways and Means committee. What is this change that is more than 3 times as expensive as all the savings from the other departments combined?

Cutting taxes on rich people.

They are throwing some bones to the rest of the population, such as removing the taxes on tips and overtime (temporarily), and making a bunch of other changes to the tax code in terms of deductions and credits and such (because that’s what we needed, a more complicated tax code!); but the majority of the decrease in revenue comes from cutting income taxes, especially at the very highest brackets.

The University of Pennsylvania estimates that the poorest 40% of the population will actually see their after-tax incomes decrease as a result of the bill. Those in the 40% to 80% percentiles will see very little change. Only those in the richest 20% will see meaningful increases in income, and those will be highest for the top 5% and above.

The 95-99% percentile will see the greatest proportional gain, 3.5% of their income.

But the top 0.1% will see by far the greatest absolute gain, each gaining an average of $385,000 per year. Every one of these people already has an annual income of at least $4 million.

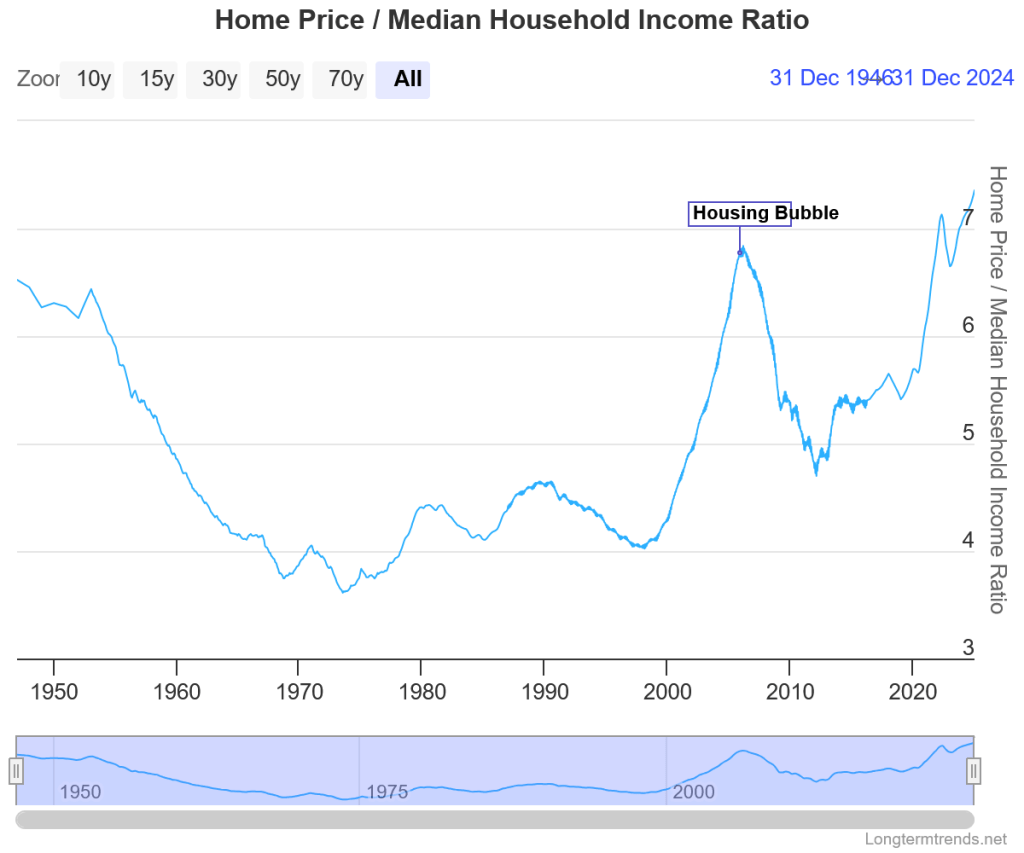

The median price of a house in the United States is $416,000.

That is, we are basically handing a free house to every millionaire in America—every year for the next 10 years.

That is why we’re adding $3.7 trillion to the national debt. So that the top 0.1% can have free houses.

Without these tax cuts, the new budget would actually reduce the deficit—which is really something we ought to be doing, because we’re running a deficit of $1.8 trillion per year and we’re not even in a recession. But because Republicans love nothing more than cutting taxes on the rich—indeed, sometimes it seems it is literally the only thing they care about—we’re going to make the deficit even bigger instead.

I can hope this won’t make it through the Senate, but I’m not holding my breath.