Aug 11 JDN 2458707

I recently got back from a trip to Disney World; while most of the attractions are purely fictional and designed only to entertain, a few are factual and designed to inform and persuade. One of these is the “Carousel of Progress”.

The Carousel of Progress consists of a series of animatronic stages, each representing the lifestyle of a particular historical era. They follow the same family over time, showing what their life is like in each era. When it was originally built, the eras shown were 1900s, 1920s, 1940s, and 1960s; but over time they have updated the “present day” stage, and now they are 1900s, 1920s, 1940s, and 1990s. The aim of the attraction is to show how technology has made our lives better.

The family they show is upper-middle class; this makes sense, as most of the audience probably is as well. But to really understand the progress we have made, we need to also consider the full range of incomes.

In this post I will go through a similar sequence of eras, comparing the lifestyles of not just the middle class, but also the rich and the poor.

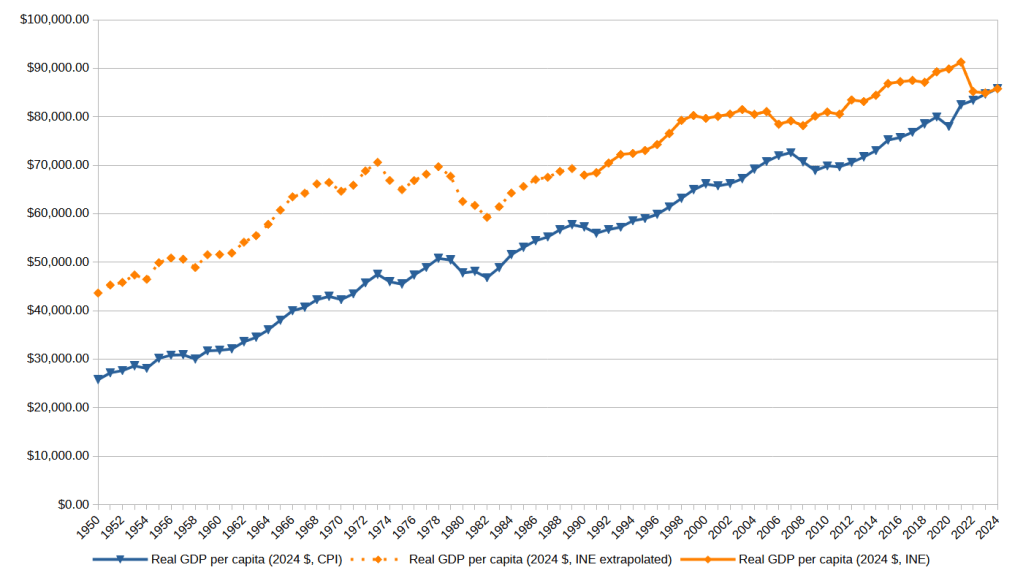

In what follows, I’ve tried to create that, using the best approximate figures on standard of living I could find from each era. The numbers are given in my best guess of the inflation-adjusted standard of living; obviously they’re much more precise in the 1980s to today than they are for earlier eras.

I’ve summarized all these income estimates in the graph below (note the log scale):

This means that, after a bumpy ride through the Middle Ages and the Industrial Revolution, we did actually raise the floor—the poor today are about as well off as the middle class in ancient times. But we raised the ceiling an awful lot faster; the rich today are something like a thousand times as rich as the rich in ancient times.

50 AD: Roman Empire

Rich: Patrician

Life is good! My seaside villa is one of the finest in Rome, and my industrious slaves fulfill my every need. At my personal zoo I recently acquired a lion and an elephant. I dine on only the finest foods, including wine from my personal vineyard. An aqueduct feeds directly into my personal baths. The war in Gallia seems to be going well; I look forward to my share of the spoils.

Wealth: $4 million

Income: $200,000

Middle class: Plebeian

Things could be worse. My family has a roof over our heads and bread on our table, so I’m grateful for that. But working all day on the farm is exhausting, and we can’t afford servants to help. My oldest son is a gladiator, though so far he has not attained the highest ranks of the profession. My youngest son was recently drafted into military service in Gallia; I pray for his safety.

Wealth: $10,000

Income: $10,000

Poor: Proletarian

Wealth: $0

Income: $1,000

Living in a hovel I don’t even own with my four children and begging on the streets isn’t an easy life, but at least I’m not a slave. Most of our food is provided by public services. With the war raging in Gallia, one of our small blessings is that we are actually too poor to be drafted into service.

1000 AD: Medieval England

Rich: Duke

While living in a castle is nice, I sometimes wish an end to the frequent raids and border skirmishes that made these high walls necessary. Still, I can’t complain; I own plenty of land, and have plenty of serfs to work it. I am in good favor with the king, and so His Majesty’s army has helped protect my lands against invasion. I have all the feasts, wine, and women a man could ask for.

Wealth: $2 million

Income: $100,000

Middle class: Knight

I can’t complain. It is an honor to be a knight in His Majesty’s army, and I am proud that my family was able to earn enough wealth to buy me a horse, a sword, and the training necessary to reach this rank. I own a little bit of land, but my lord has called upon me for a new campaign, I’m hoping to buy a larger estate with the spoils I earn from it. My family has plenty of food to eat, though if the well runs dry I’m not sure where we’ll get more water.

Wealth: $5,000

Income: $5,000

Poor: Serf

Live grows harder by the day, it seems. My lord keeps demanding more and more work from us, but already the land is producing as much as it can bear. Though we are responsible for planting and harvesting the wheat, often the bread never makes it to my family’s table.

Wealth: $0

Income: $500

1600 AD: Renaissance Venice

Rich: Noble

With the advent of global trade and colonization, wealth has flooded into Venice, and I have had the chance to claim some portion of that flood. I dress in the finest silks, and eat exotic foods from lands as distant as India and China. Servants fulfill my every need. How could life be better?

Wealth: $10 million

Income: $1 million

Middle class: Merchant

I am a proud member of the trader’s guild. Though it our trade ships that carry wealth from across the seas, we often find that wealth passing on up to the nobles, leaving little for ourselves. Still, I have my own land, my own house, and plenty of food for my family.

Wealth: $10,000

Income: $10,000

Poor: The Pebbles

I had a good job working in construction until recently, but I was laid off. I could no longer afford my rent, so now I live on the streets. I feel as though I work constantly but never can find a way to get ahead.

Wealth: $0

Income: $2,000

1750 AD: Pre-Revolutionary France

Rich: Noble

Viva la France! Life is better than ever. Servants do all my work, while the wealth produced by my fields and factories all goes to me. I barely even pay any taxes on my grand estates.

Wealth: $20 million

Income: $2 million

Middle class: Bourgeoisie

I live reasonably well, all things considered. My family has a home and enough food to eat. Still, taxes are becoming increasingly onerous even as the nobles become increasingly detached from the needs of common people like us. Still, we may as well accept it; I doubt things will change any time soon.

Wealth: $15,000

Income: $15,000

Poor: Peasant

Life is hard. I work all day on the farm to make wheat, and then the nobles tax it all away. We have to make our own clothes even as the nobles luxuriate in silks from around the world.

Wealth: $0

Income: $500

1900 AD: United States

Rich

My coal mine has been a roaring success! I am now one of the richest men who has ever lived. I even have my own horseless carriage. Servants are getting more expensive these days, though; even though I’m richer than my grandfather I can’t afford as many servants.

Wealth: $1 billion

Income: $100 million

Middle class

“Well, the robins are back. That’s a sure sign of spring. What year is it? Oh, just before the turn of the century. And believe me, things couldn’t be any better than they are today. Yes sir, we got all the latest things: gas lamps, a telephone, and the latest design in cast iron stoves. That reservoir keeps five gallons of water hot all day on just three buckets of coal. Sure beats chopping wood! And isn’t our new ice box a beauty. Holds 50 pounds of ice. Milk doesn’t sour as quick as is used to. Our dog Rover here keeps the water in the drip pan from overflowing. You know, it wasn’t too long ago we had to carry water from a well. But thanks to progress, we’ve got a pump right here in the kitchen. ‘Course we keep a bucket of water handy to prime it with. Yes sir, we’ve got everything to make life easier. Mother! I was reading about a fellow named Tom Edison, who’s working on an idea for snap on electric lights.”

Wealth: $18,000

Income: $18,000

Poor

I live on the streets most of the time. I eat food out of the garbage. What little money I have is earned by begging. I’m not proud, but it’s all I can do to survive.

Wealth: $0

Income: $2,000

1920 AD: United States

Rich

Life is sweet. My electric company is raking in the dough these days; seems they can hardly find enough copper to lay all the new cables we need to supply all the folks buying into our grid. I have four automobiles now—all top of the line of course. The times, they are a-changin’: Can you believe they gave women the vote? Eh, well, I suppose they can hardly vote worse than us men do already.

Wealth: $5 billion

Income: $500 million

Middle class

“Whew! Hottest summer we’ve had in years. Well, we’ve progressed a long way since the turn of the century 20 years ago. But no one realized then that this would be the age of electricity. Everyone’s using it: farmers, factories, whole towns. With electric streetlights we don’t worry so much about the youngsters being out after dark. And what a difference in our home. We can run as many wires as we need in any direction for Mother’s new electrical servants: electric sewing machine, coffee percolator, toaster, waffle iron, refrigerator, and they all go to work at the click of a switch. Take it easy! You’ll blow a fuse! Queenie! Leave ’em alone. Well, the days of lugging heavy irons from the old cookstove to an ironing board are gone forever. With an electric iron and electric lights, Mother now has time to enjoy her embroidery in the cool of the evening. Right, Mother?”

Wealth: $20,000

Income: $20,000

Poor

Life on the streets is still hard, but at least they’ve got these new soup kitchens to feed me and my family, and with running water in the city we can sometimes get clean water to drink. That newfangled electricity stuff is supposed to be the bee’s knees, but we sure can’t afford it.

Wealth: $0

Income: $4,000

1940 AD: United States

Rich

My steel company is doing extremely well, particularly with the war in Europe raising the price of steel. We just bought our very own airplane; isn’t that marvelous? With Britain under siege and France already fallen to the Krauts, I think we’re gonna end up in the war soon—FDR certainly has been making noises to that effect. If I were poor, I’d be worried about my sons getting drafted; but I’m sure we won’t have to worry about that. No, I’m just looking forward to my stock returns when they start churning out tanks instead of cars in Detroit!

Wealth: $2 billion

Income: $200 million

Middle class

“Well it’s autumn again and the kids are back in school. Thank goodness! Here we are in the frantic forties and the music is better than ever. And it’s amazing how our new kitchen wonders are helping to take over the hard work. Everything is improving. Electric range is better. Refrigerators are bigger and make lots more ice cubes. But my favorite is the electric dishwasher. Now Mother spends less time in the kitchen and I don’t have to dry the dishes anymore. Oh, I spend a lot of time here. Have to. Now that television has arrived, Grandma and Grandpa have taken over my den. Television has changed our lives. It’s brought a whole new world of culture into our home.”

Wealth: $24,000

Income: $24,000

Poor

The Depression was hard on everybody, but I think it was hardest on us poors. This New Deal business seems to be helping out a lot, though; on one of the new construction projects I was able to find work for the first time in months. I’m worried we’re going to be brought into the war soon, but if I get drafted at least that means three squares a day.

Wealth: $0

Income: $4,000

1960 AD: United States

Rich

Running an oil company is not for the faint of heart; they keep adding more onerous regulations every year. Still, profits are bigger than ever. I just wish Uncle Sam would stop taking such a big cut; Commies, all of them. I can barely afford upkeep on my yacht these days with all the taxes.

Wealth: $2 billion

Income: $200 million

Middle class

We just got a color TV at home, and we’ve been watching around the clock. We get all four channels! And my new T-bird is a real beauty; paid a fortune for her, but worth every penny. Society is improving, too; with Rosa Parks and whatnot, I’m guessing things are about to get a lot better for colored folks especially. After that, I’m thinking it’ll be the gays’ turn next; I wonder how long that will take.

Wealth: $30,000

Income: $30,000

Poor

Life is still hard, but I think it’s better now than it’s ever been, even for poor folks like me. Thanks to Welfare, I’m not even as poor as I could be. It’s tough to make ends meet, but at least I can afford a place to live and food to eat. And I’m pretty healthy too: Antibiotics and vaccines mean that we are finally safe from some terrible diseases, like polio. It seems crazy: Just a generation ago the President had a disease that now even folks like me are protected from.

Wealth: $0

Income: $6,000

1980 AD: United States

Rich

They told me I was crazy to invest in these “personal computing machines”, but I saw the writing on the wall. Computers are the future, man. They’re gonna be everywhere, and do everything. We’re gonna have robots and flying cars, and if I have anything to say about it, I’m gonna own the factories that make them.

Wealth: $5 billion

Income: $500 million

Middle class

We have our own PC now. I use it for work, but my kids use it mostly for computer games. I still can’t beat my daughter at Pong, but I can at least hold my own at Pac-Man these days. I hear that programming skills are going to be in high demand soon, so I’ve been trying to teach the kids BASIC.

Wealth: $50,000

Income: $50,000

Poor

Nixon’s Welfare “reform” really hit my family hard. If I don’t find work soon, they’re going to cut my benefits; but if I could find work, what would I need benefits for? Jimmy Carter made some things better, but it doesn’t look like he’ll be re-elected. Can you believe that old actor Ronald Reagan is running?

Wealth: $0

Income: $8,000

2000 AD: United States

Rich

I sure played my cards right in the stock market, buying those tech firms just before the Internet boom really hit. Now I have my own jet and I’m thinking of buying a yacht. Maybe I’ll diversify into real estate; it looks like housing prices are heading north.

Wealth: $10 billion

Income: $1 billion

Middle class

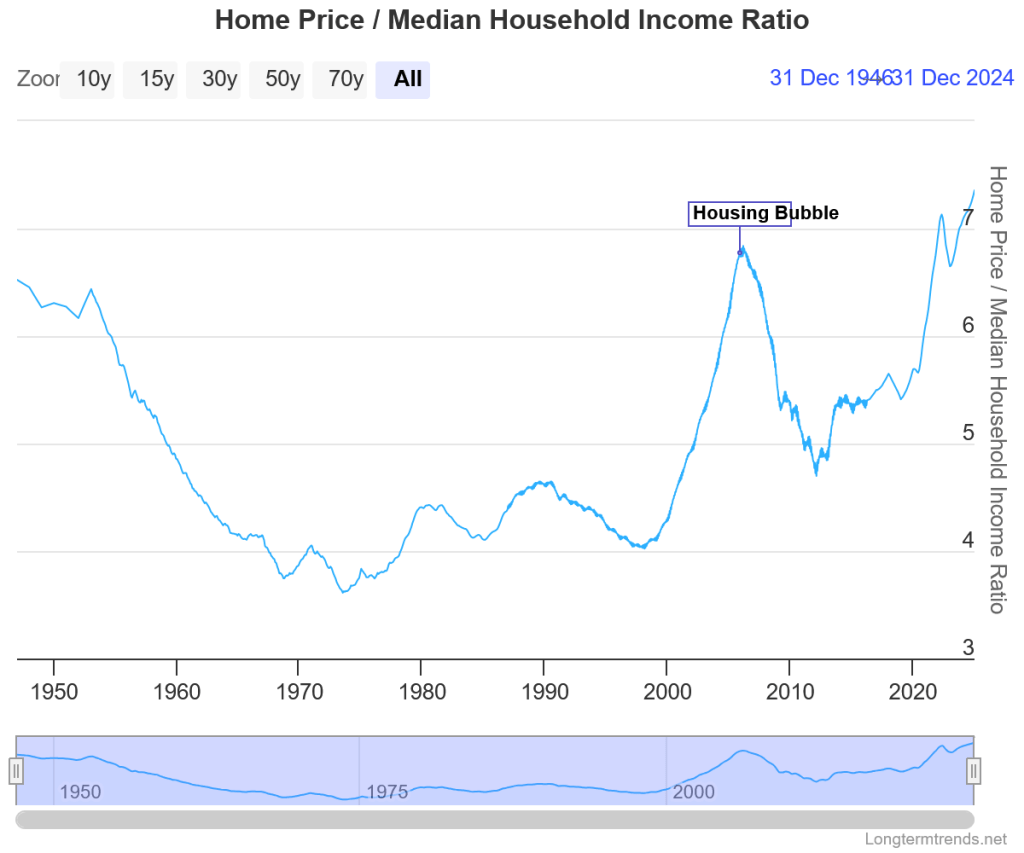

Our home has almost doubled in value since we bought it; we took some of that out as a home equity loan, which helped us buy laptops for our kids. It’s amazing what they can do now; we used to have a big clunky desktop, and these little laptops would run circles around it. We also installed a 56k modem; I’m a little worried about what effect the Internet will have on the kids, but it seems like that’s where everything is going.

Wealth: $60,000

Income: $60,000

Poor

I hate working in fast food, but it beats not working at all. I really wish they’d raise minimum wage though; once you figure in inflation, we’re actually making less than people did ten years ago. I think I qualify for Welfare or something, but the paperwork has gotten so crazy I couldn’t even deal with it. I’m just trying to get by on what I make at the burger joint.

Wealth: $0

Income: $10,000

2020 AD: United States, Present Day

Rich

I knew my app startup would be a success, but even I couldn’t have predicted we’d make it this far. Bought out by Apple for $40 billion? I could hardly have dreamed it myself. I am living the high life; I’ve got my own helicopter now, and a yacht 50 feet long (#lifestyle #swag!). I just upgraded my Google Glass to the new model; it is awesome AF. I think I might move out of the Bay Area and get myself a mansion in Beverly Hills.

Wealth: $20 billion

Income: $2 billion

Middle class

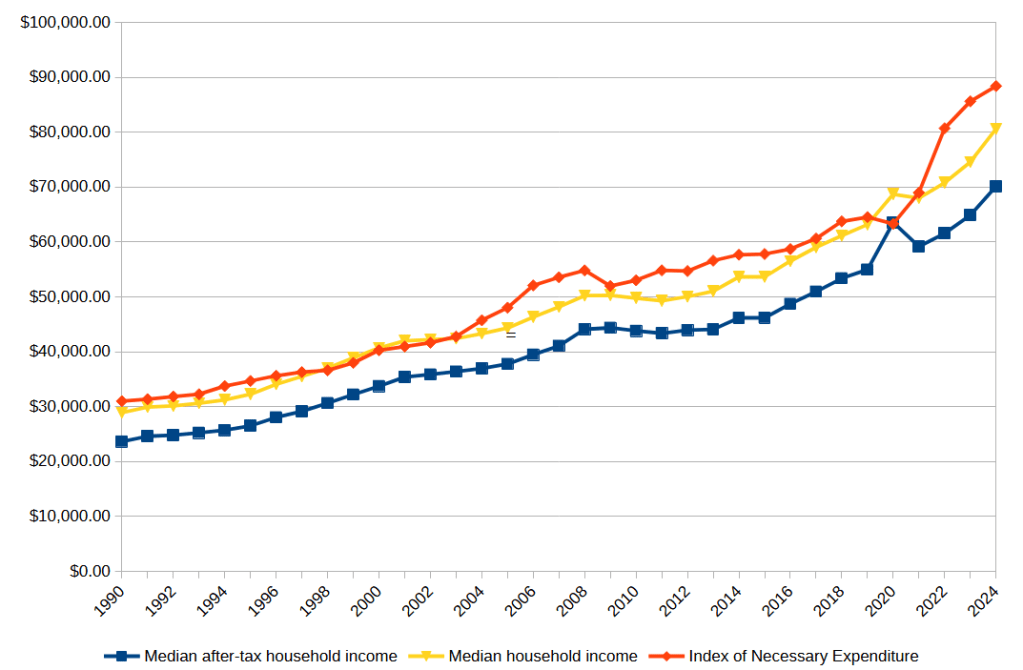

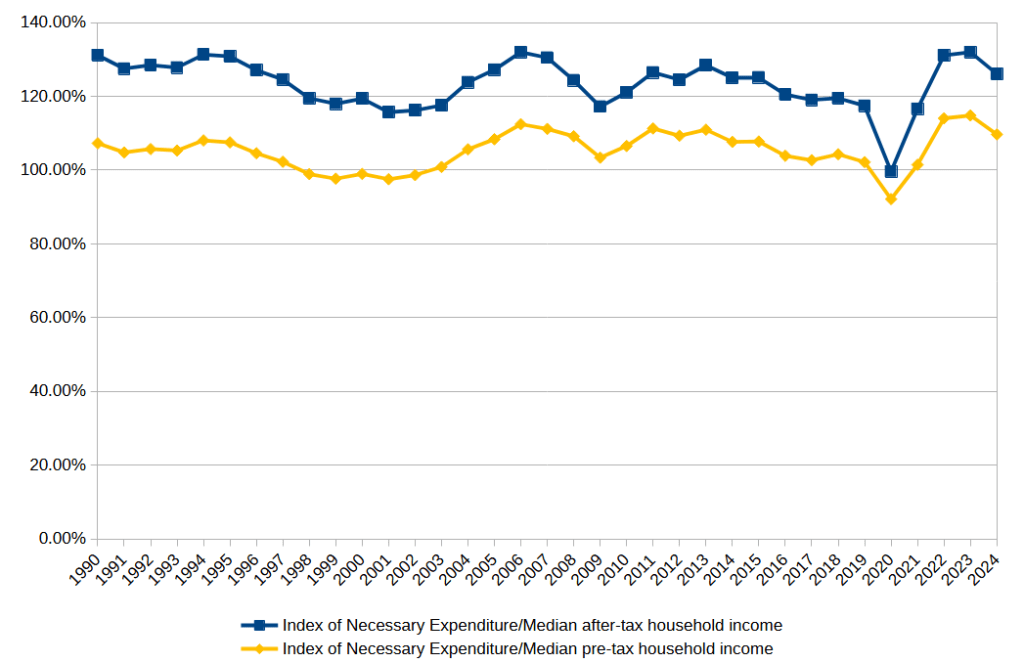

Why is rent so expensive? And how am I ever going to pay off these student loans? After college I managed to land an office job because I’m pretty good with Excel, but it’s still tough to make ends meet. Smartphones are cool and all, but it would be nice to actually own my own home. I think my parents had planned for me to inherit theirs, but we lost it in the subprime crash. Eh, things could be worse. #FirstWorldProblems.

Wealth: $62,000

Income: $62,000

Poor

Things were really bad a few years ago, but they seem to be picking up a little now; I’ve been able to find a job, at least. But it doesn’t pay well; I can’t barely afford rent. I don’t have what they call “marketable skills”, I guess. I should have gone back to school, probably, but I didn’t want to have to deal with student loans. Maybe things will be better once Trump finally gets out of office.

Wealth: $0

Income: $12,000

2040 AD: United States, Cyberpunk Future

Rich

I guess I picked out the right crypto to buy, because it gave me enough to buy my own AI company and now I’m rolling in it. My new helicopter is one of those twin-turbofan models that runs on fuel cells—I was sick of paying carbon tax to fuel up the old kerosene model. I just got cybernetic implants: No phone to carry around, nothing to get lost! I hear they’re working on going to neural interface soon, so we won’t even need to wave our hands around to use them.

Wealth: $40 billion

Income: $4 billion

Middle-class

I used to have a nice job in data analysis, but they automated most of it and outsourced the rest. Now I work for a different corp doing customer service, because that’s the only thing humans seem to still be good for. I have to admit the corps have done some good things for us, though; my daughter was born blind but now she’s got artificial eyes. (Of course, how will we ever pay off those medical debts?) And I really wish someone had done something about climate change sooner; summers these days are absolutely unbearable.

Wealth: $65,000

Income: $65,000

Poor

Wealth: $0

Income: $15,000

I lost my trucking job to a robot, can you believe that? But how am I supposed to compete with 22 hours of daily uptime? Basic income is just about all the money I have. I haven’t been able to find steady work in years. I should have gone to college and studied CS, probably; it seems like salaries in AI get higher every year.